Commercial Real Estate Asset Management Software | Best UK Platforms & 2025 Guide

Commercial Real Estate Asset Management Software has become a cornerstone of modern property investment and management in the UK. As property portfolios expand, managing leases, tenants, and finances manually has become inefficient and error-prone. Software solutions step in to simplify complex processes, allowing managers and investors to gain clarity over their assets and make better decisions.

In today’s market, property performance is closely tied to data accuracy and operational efficiency. Commercial Real Estate Asset Management Software provides both, ensuring property owners and companies can maximise returns while reducing risks. This guide explores what commercial real estate asset management means, the role of software, the best platforms in the UK, and how the industry is evolving for the future.

What is Commercial Real Estate Asset Management

Commercial real estate asset management is the professional practice of overseeing and enhancing the financial performance of investment properties. It goes beyond day-to-day property maintenance, focusing instead on long-term planning, financial tracking, and value optimisation. Asset managers are tasked with maintaining profitability while ensuring tenants and stakeholders remain satisfied.

Different commercial real estate asset classes, such as retail, industrial, office spaces, and mixed-use developments, require specific strategies. This is where the expertise of commercial real estate asset managers becomes vital. Their role involves balancing operational efficiency with market trends and investment goals. Commercial Real Estate Asset Management Software supports these efforts by centralising data and providing insights that drive stronger financial outcomes.

The Role of Software in Asset Management

In a competitive market, manual spreadsheets and outdated systems no longer meet the demands of complex portfolios. Commercial Real Estate Asset Management Software allows professionals to automate reporting, track lease agreements, and evaluate property performance in real time. The automation of repetitive tasks also saves time, reduces human error, and improves transparency across teams.

For commercial real estate asset management companies, software delivers a competitive advantage by creating unified platforms for collaboration. Financial reports, tenant communication, and asset performance data can be accessed at any time, ensuring that managers can respond quickly to market shifts. This makes software indispensable for investors seeking sustainable returns.

Best Commercial Real Estate Asset Management Software in the UK

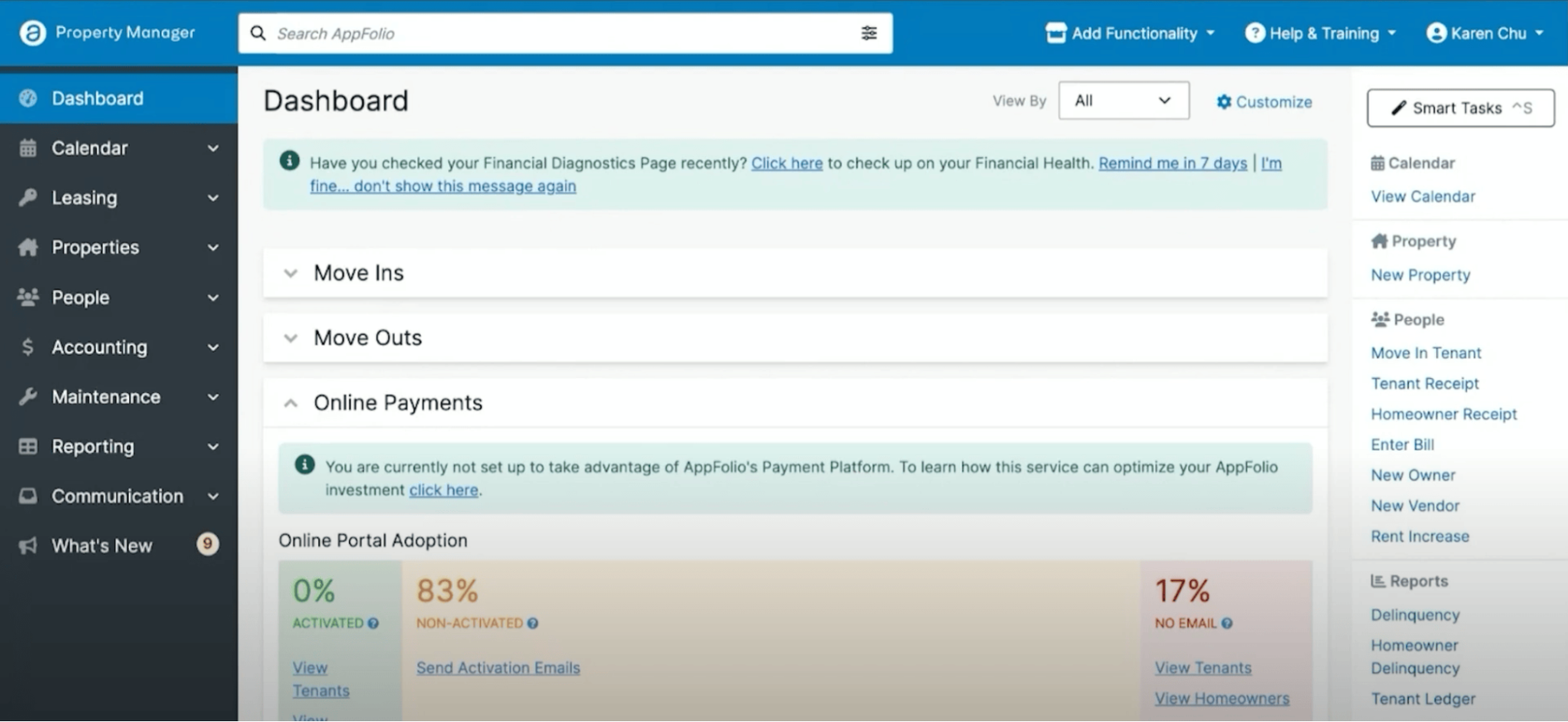

The UK property market offers several leading platforms designed for landlords, investors, and large-scale asset management firms. Popular solutions include Yardi, MRI Software, Re-Leased, Coyote, AppFolio, and ARGUS. Each platform provides unique features such as advanced financial tracking, data consolidation, and portfolio performance monitoring tailored to different business sizes.

Commercial Real Estate Asset Management Software reviews highlight that these tools improve efficiency and help asset managers identify opportunities for growth. Yardi and MRI, for instance, are favoured for their comprehensive reporting tools, while Re-Leased appeals to property managers seeking cloud-based solutions. Choosing the best platform depends on portfolio size, operational complexity, and budget.

Key Benefits of Using Asset Management Software

Commercial Real Estate Asset Management Software improves property performance by providing accurate insights into revenue, expenses, and occupancy. Investors benefit from real-time data and detailed reports, which allow them to make informed decisions about where to allocate resources. Asset managers can also use predictive analytics to forecast trends and plan for the long term.

Another key advantage is risk management. With better access to data, managers can develop strategies for asset recovery, mitigate potential losses, and adapt to market changes. Transparency and compliance are also strengthened, making reporting to investors and regulators far more efficient. For landlords and companies, the return on investment in software is clear.

Challenges and Considerations Before Choosing a Platform

While Commercial Real Estate Asset Management Software offers many advantages, businesses must consider certain challenges before committing to a platform. Costs, training requirements, and integration with existing systems can all impact implementation. For smaller landlords, subscription fees may be difficult to justify unless the software provides measurable value.

Security and compliance also play a critical role in the decision-making process. With GDPR regulations in the UK, ensuring data protection is non-negotiable. Additionally, asset managers must evaluate whether the software supports all relevant commercial real estate asset classes and whether it can scale as portfolios expand. Careful research is essential before making a final choice.

Career Outlook for Commercial Real Estate Asset Managers

The rise of Commercial Real Estate Asset Management Software has reshaped the career landscape for asset managers. Professionals are now expected to combine financial expertise with technical proficiency in software platforms. This blend of skills makes them highly valuable to property firms and investment companies.

In the UK, the average commercial real estate asset manager salary is competitive, reflecting the demand for skilled professionals. Job opportunities continue to grow as more companies adopt digital systems. Those with the ability to interpret data and leverage software effectively are likely to enjoy strong career prospects in 2025 and beyond.

The Future of Commercial Real Estate Asset Management

The property industry is rapidly embracing digital transformation, and Commercial Real Estate Asset Management Software is at the centre of this evolution. The future lies in artificial intelligence, automation, and mobile-first platforms that allow asset managers to work flexibly and make data-driven decisions on the go.

Internationally, countries like Germany are advancing in software adoption, but the UK continues to lead in innovative platforms. With demand for transparency, efficiency, and sustainability, asset management software will remain a crucial part of the industry. Those who adopt early and adapt to new technologies will stay ahead of competitors.

Conclusion

Commercial Real Estate Asset Management Software has revolutionised the way properties are managed in the UK. By providing automation, real-time insights, and advanced reporting, it allows asset managers to improve performance while reducing risks. Investors benefit from better transparency and higher returns, while companies enjoy greater efficiency and compliance.

Selecting the right platform is essential, as it must align with portfolio size, costs, and business objectives. As technology continues to advance, software solutions will become even more powerful, making them an indispensable tool for property professionals seeking growth in 2025 and beyond.

FAQs

What is the difference between property management and asset management?

Property management focuses on day-to-day tasks like rent collection, while asset management emphasises financial growth and portfolio performance.

Which is the best commercial real estate asset management software in the UK?

Yardi, MRI, Re-Leased, Coyote, and ARGUS are among the leading platforms in 2025.

How much do commercial real estate asset management companies charge in fees?

Fees depend on portfolio size, services provided, and the type of software used.

What is the average salary for a commercial real estate asset manager in the UK?

Salaries are competitive, with growth opportunities linked to technology adoption and market demand.

Can asset management software improve portfolio performance?

Yes, software enhances decision-making by providing accurate data, risk analysis, and performance tracking tools.

You May Also Read: Why Choose Secure Dog Fields Over Public Spaces