How Much is IHT Nil Rate Band in 2025? UK Inheritance Tax Allowances Explained

When planning estates, a common question is How Much is IHT Nil Rate Band. The nil rate band is the amount of an estate that can be passed on without paying Inheritance Tax. It plays a key role in estate planning for families across the UK.

Understanding the nil rate band in 2025 is vital. With thresholds frozen and property values rising, more estates are affected. This article explains how the nil rate band works, its history, and what families need to know to manage inheritance effectively.

What is the IHT Nil Rate Band

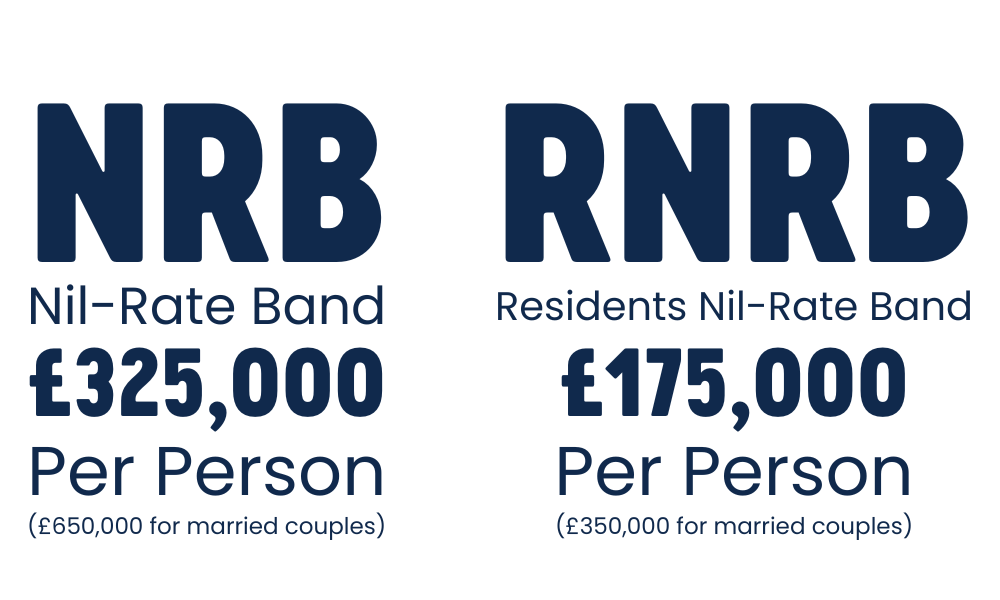

The IHT nil rate band is the tax-free allowance that individuals can leave to heirs. For 2025, the basic nil rate band remains £325,000, frozen since 2009. This allowance applies to all estates and is a critical part of UK estate planning.

In addition to the basic allowance, the residence nil rate band provides extra relief for passing a main home to direct descendants. Many people search How Much is IHT Nil Rate Band to understand how much they can pass on without facing tax.

IHT Nil Rate Band in 2025

For 2025, the nil rate band is £325,000 per individual, with an additional £175,000 for the residence nil rate band. Combined, single individuals can pass £500,000 tax-free, while married couples can leave up to £1 million without paying IHT.

Since these thresholds are frozen until 2028, rising property values mean more estates may exceed the allowance. Understanding How Much is IHT Nil Rate Band is essential for those planning estates and passing on wealth effectively.

The Residence Nil Rate Band Explained

The residence nil rate band is designed to help homeowners pass on their main residence to children or grandchildren. The allowance is £175,000 per person, increasing the total tax-free inheritance amount.

However, the relief is reduced for estates valued over £2 million. Considering the residence nil rate band is an important part of answering the question How Much is IHT Nil Rate Band, as it significantly affects how much of a property can be passed tax-free.

Transferable Nil Rate Band Between Spouses

One key advantage of the nil rate band is that it can be transferred between spouses or civil partners. If one partner does not use their allowance, it can be added to the surviving partner’s allowance.

For example, a married couple can combine their allowances, giving a total of £650,000 plus the residence nil rate band. Couples frequently check How Much is IHT Nil Rate Band together to ensure their combined estate planning is maximised.

IHT Nil Rate Band History and Trends

The nil rate band has risen slowly over the years. In 2003, it was £255,000, and by 2009 it reached £325,000, where it has remained. Despite house price increases, the allowance has been frozen, meaning more estates are now subject to tax.

Reviewing the history helps families understand why the question How Much is IHT Nil Rate Band is increasingly relevant. Frozen thresholds, combined with rising property values, make it critical to plan carefully to reduce tax exposure.

Using an IHT Nil Rate Band Calculator

An IHT nil rate band calculator is a useful tool to estimate potential tax liabilities. By inputting estate values, debts, and exemptions, families can see how much inheritance may be taxable.

While calculators provide a helpful estimate, professional advice is still important. They help answer How Much is IHT Nil Rate Band in practice and give a clearer picture of tax obligations.

Planning Ahead for Inheritance Tax

Proactive planning is essential as thresholds remain frozen. Strategies such as lifetime gifts, using trusts, and charitable donations can reduce the estate’s taxable value. Reviewing wills and estate plans regularly ensures allowances are used effectively.

Asking How Much is IHT Nil Rate Band is the first step. Planning ahead helps families pass on wealth efficiently and avoid unnecessary tax, preserving more for the next generation.

Conclusion

The nil rate band in 2025 remains £325,000, with an additional residence allowance of £175,000. These thresholds are frozen until 2028, meaning more estates may face Inheritance Tax.

Knowing How Much is IHT Nil Rate Band allows families to plan effectively, use available allowances, and ensure wealth is passed on with minimal tax. Careful planning is essential to protect family assets.

FAQs

How much is the IHT nil rate band in 2025?

The nil rate band is £325,000 per individual, plus a £175,000 residence allowance.

Can the nil rate band be transferred to a spouse?

Yes, unused allowance can be transferred to a surviving spouse or civil partner.

What is the residence nil rate band?

An additional allowance of £175,000 when leaving a main home to direct descendants.

When will the nil rate band change?

The government has frozen the allowance until at least April 2028.

How has the nil rate band changed over time?

It rose gradually from £255,000 in 2003 to £325,000 in 2009 and has remained frozen since.

You May Also Read: Planning Your Coastal Day Trip with Dogs